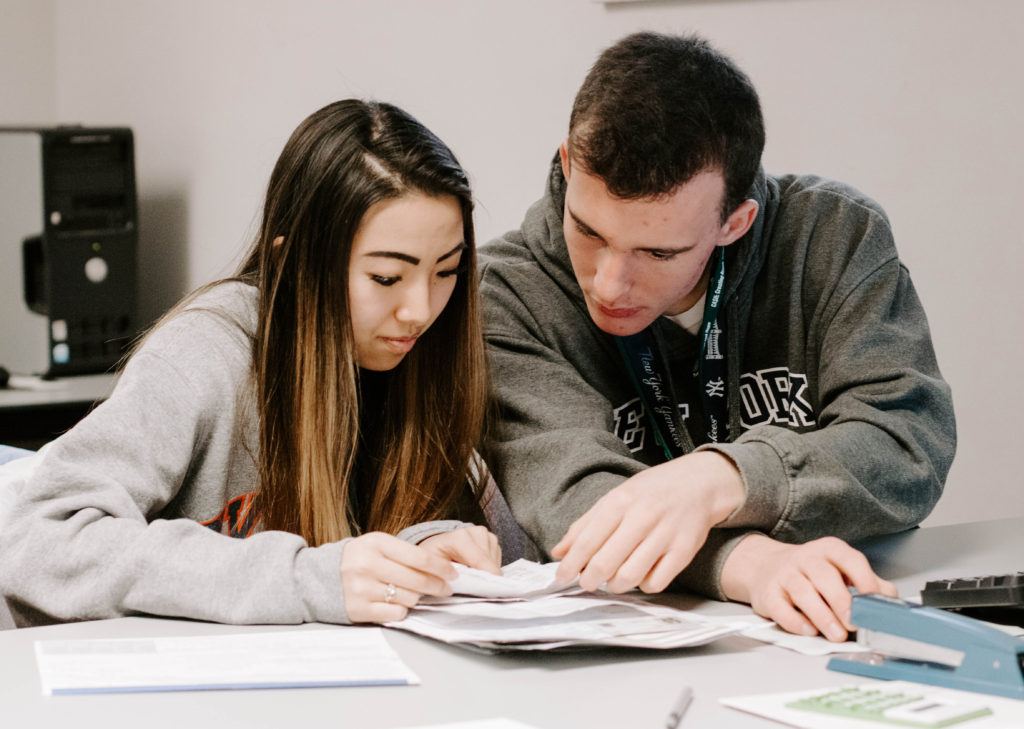

ALBANY, N.Y. (CNS) — High school junior Paul Barber shuffles through tax forms in the basement of the diocesan Pastoral Center in Albany. At Catholic Central High School in nearby Troy, Barber is like any other student; here, he’s an accountant.

“I get to actually come here and help people which is great,” Barber told The Evangelist, Albany’s diocesan newspaper. “Coming from a Catholic school and a Catholic family, getting to help people is great.”

Barber is one of many student volunteers who help locals in the Albany Diocese file their tax returns under the Catholic Charities Volunteer Income Tax Assistance program, known as VITA.

VITA works in collaboration with the CA$H (Creating Assets, Savings and Hope) Coalition of the Greater Capital Region. It offers free tax preparation services from Internal Revenue Service-trained and certified volunteers to individuals or families with a maximum household income of $54,000.

VITA has collaborated with Catholic Central students since its inception almost 15 years ago. The program allows students to gain hands-on experience in the accounting field.

Mary Olsen, VITA program director, said students from the College of St. Rose, Siena College and SUNY Albany also volunteer. The program teaches students a level of professionalism, she said, so clients can feel comfortable having their taxes done by someone so young.

“One woman said earlier, ‘These are high school kids?'” Olsen said. “And I said, ‘Oh yes, and they are certified by the IRS, and they’ve been doing this for a long time.'”

George Hannah, accounting and business teacher at Catholic Central, said all students enrolled in his accounting class are required to volunteer with VITA. Students also receive training from a VITA member before they can volunteer.

While Catholic Charities oversees the program offered in the Pastoral Center, the CA$H Coalition offers numerous VITA sites around the diocese, such as at St. Matthew’s Church in Voorheesville, as well as the Saratoga Springs Public Library.

In 2016, the program helped 887 people file their taxes, saving them more than $240,000. Last year, the program helped nearly 1,000 taxpayers.

All volunteers help clients with preparing their tax returns and determine if they are eligible for valuable tax credits. Student volunteers work in pairs, and every return is checked by an advanced certified accountant.

Olsen said that most clients taking advantage of the service are returnees. “When they leave you say, ‘OK, I’ll see ya next year!’ And we do.”

Jean Dobbs, who has been getting her taxes done by Catholic Charities for four years, said the savings she has realized helps pay for food and bills.

Dobbs, who was a program director with Catholic Charities for more than 30 years, adds that coming to VITA lets her revisit old friends in retirement.

“It’s like coming home,” she said.’

— By Emily Benson, Catholic News Service. Benson is a staff writer for The Evangelist, newspaper of the Diocese of Albany.